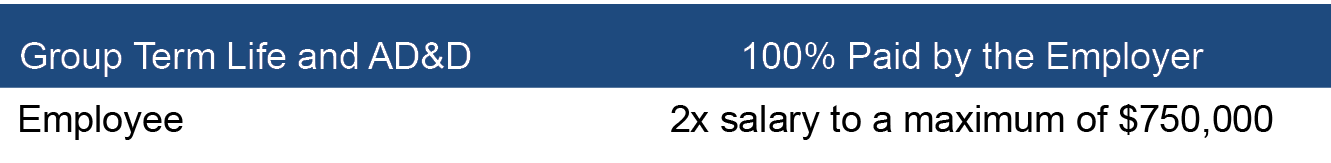

REGENXBIO’s comprehensive benefits package includes financial protection for you and your family in the event of an accident or death through Reliance Standard.

Group term life and accidental death and dismemberment (AD&D) coverage are provided automatically at no cost to you upon employment.

In the event of your death, the life insurance policy provides a benefit to the beneficiary you designate. If your death is the result of an accident or if an accident leaves you with a covered debilitating injury, an additional benefit is provided under AD&D.

Helpful Insurance Terms

Imputed income: Federal regulations require payment of income and Social Security taxes on the value of the life insurance premiums in excess of $50,000 when paid for by your employer. The value of dependent life coverage paid for by your employer is also taxable. These values are known as imputed income. Contact your tax professional for information regarding these tax consequences if you have questions or concerns.

Age reduction: Your life benefit will reduce as you age. The group term basic life and AD&D insurance coverage will reduce to 65% at age 65 and to 50% at age 70; supplemental life benefits will reduce beginning at age 75.

Voluntary Life/Accidental Death & Dismemberment

In addition to the basic life/AD&D paid for by REGENXBIO, you may elect supplemental life/AD&D for yourself and your dependents. You may be required to go through Evidence of Insurability for coverage

- Employee – you may elect up to $500,000 in supplemental life coverage for yourself.

- Dependent – you may elect up to $500,000 in life coverage for your spouse or domestic partner.

- Child(ren) – you may elect up to $10,000 in life coverage for your child(ren).

The cost of coverage is based on age, and benefit amounts will reduce starting at age 75. Costs can be found in UKG via SSO.

Ready to enroll?

Please access UKG through our SSO page to enroll in your benefits. You can also access the UKG mobile app by using the company access code “Regenxbio”. If you have any questions about your benefits, please contact HR by email or call (240) 552-8526.